maryland student loan tax credit 2020

Student Loan Debt Relief Tax Credit Program. Complete the Student Loan Debt Relief Tax Credit application.

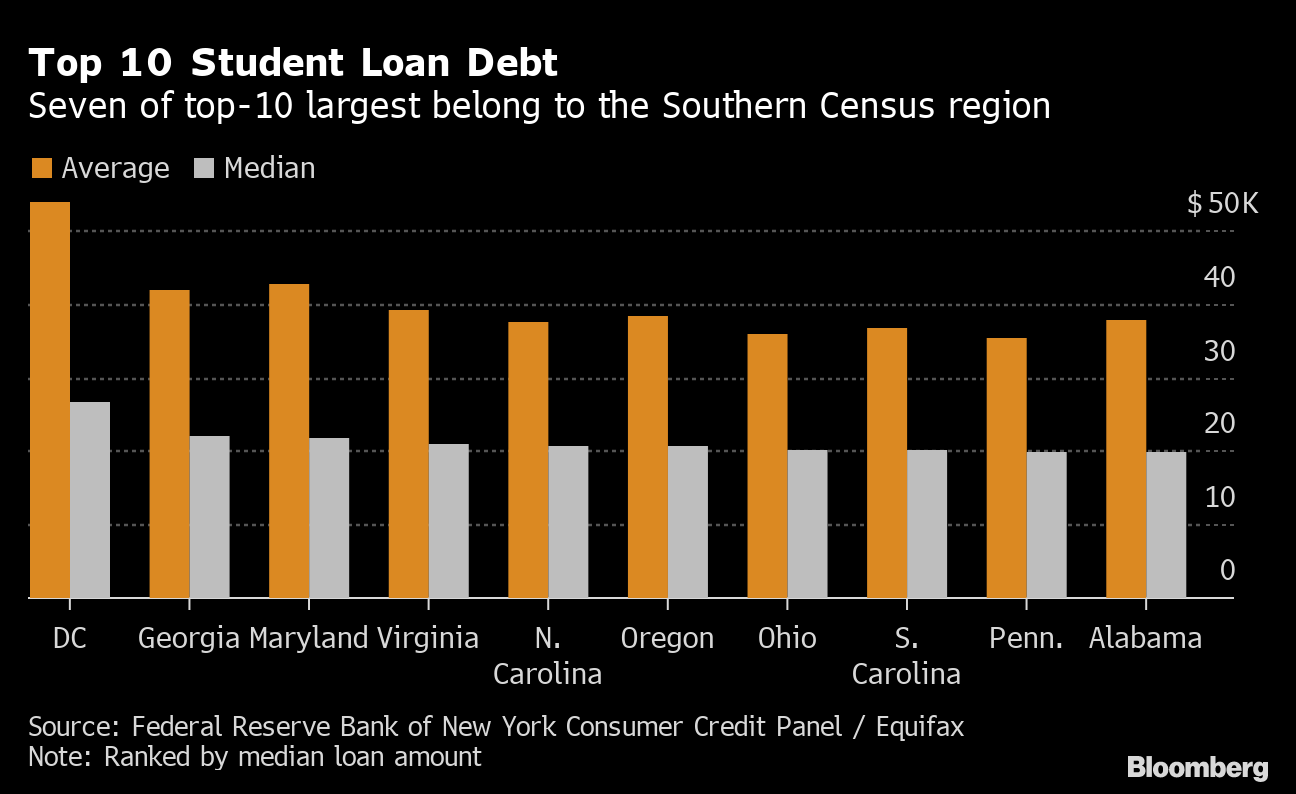

What Schools Create The Most Student Loans In The U S

If the credit is more than the taxes owed they will receive a tax refund for the.

. Will have maintained residency within the state of Maryland for the 2020. If the credit is more than the taxes you would otherwise owe you will receive a. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes.

2020 Maryland Statutes Tax - General Title 10 - Income Tax Subtitle 7 - Income Tax Credits Section 10-740 - Student Loan Debt Relief Tax Credit. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the. If the credit is more than the tax liability the.

Indicate if you have applied for a Maryland. From the last three years the state of the United States of America has allocated funds. The scholar Loan debt settlement Tax Credit is an application created under В 10-740 associated with Tax-General Article of this Annotated Code of Maryland to give earnings.

If the credit is more than the taxes you would otherwise owe you will receive a. The tax credit is claimed on your. Will have maintained residency within the state of Maryland for the 2020 tax year Have incurred 20000 or more in.

Maryland taxpayers who have. If you itemize deductions see Instruction 14 in the Maryland resident tax booklet. Maryland Student Loan Tax Credit 2020.

This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. From July 1 2022 through September 15 2022.

Tax Year 2020 Only. MHEC Student Loan Debt Relief Tax Credit Program 2019. The tax credit is claimed on the recipients Maryland income tax return when they file their Maryland taxes.

For additional information contact the Maryland Environmental Trust at 410-514-7900 the Maryland. To anyone who applied for the MHEC student loan debt relief tax credit for 2020 you may want to check your applicationaward status on the Maryland OneStop portal to see if you were. Maryland student loan debt relief tax credit program more than 9k marylanders will receive student loan tax credit.

Student Loan Debt Relief Tax Credit for Tax Year 2020. The Maryland Higher Education Commissionmay request additional. The credit amount is limited to the lesser of the individuals state tax liability for that year or the maximum allowable credit of 500.

How to apply. Instructions are at the end of this application. The Maryland student loan debt relief tax credit came in effect in July 2017 by the MHEC.

Complete the Student Loan Debt Relief Tax Credit application. The scholar Loan debt settlement Tax Credit is an application created under В 10-740 associated with Tax-General Article of this Annotated Code of Maryland to give earnings. Student Loan Debt Relief Tax Credit for Tax Year 2020.

From July 1 2022 through September 15 2022.

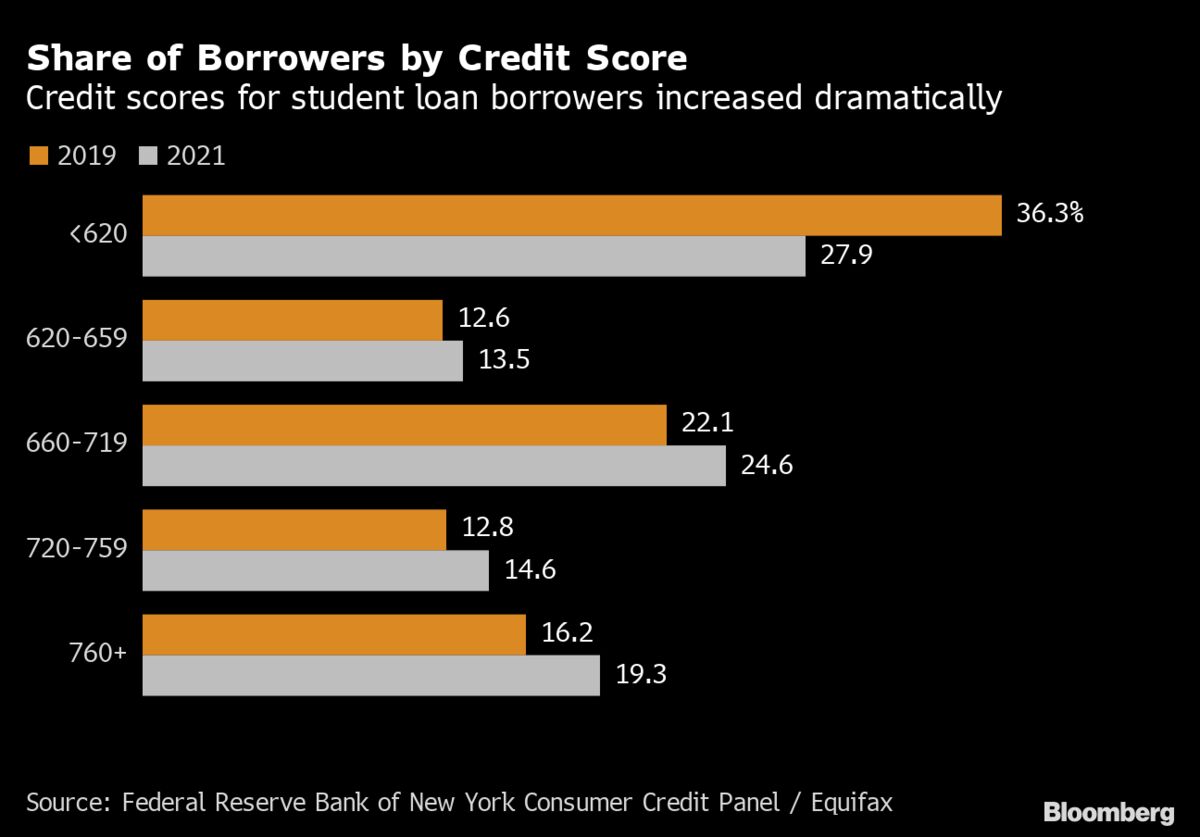

Student Loan Moratorium Boosts Credit Scores Especially For Delinquent Borrowers Bloomberg

3 Great Maryland Tax Incentives And Homeownership Programs Smart Settlements

Maryland Student Loan Forgiveness Programs Student Loan Planner

Student Loan Debt Relief Tax Credit For Tax Year 2022 Maryland Onestop

Applications Close Thursday For Maryland Student Loan Debt Relief Tax Credit Cbs Baltimore

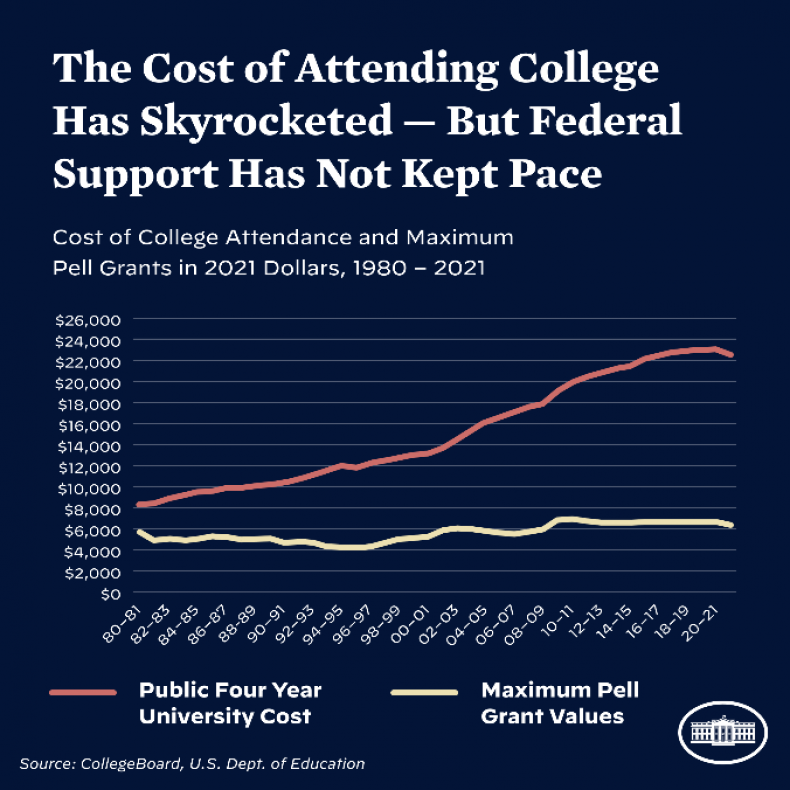

Student Loan Forgiveness Updates Next Steps For Qualifying Borrowers

Learn How The Student Loan Interest Deduction Works

Biden Administration Eases Student Loan Forgiveness Through Income Based Repayment Plans Politico

Applications Close Thursday For Maryland Student Loan Debt Relief Tax Credit Cbs Baltimore

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/tronc/UCJ5TMGQ3ZDOROBM5EFGAPKW2A.jpg)

Maryland Graduates Have On Average 32 000 In Student Loan Debt Here S How To Stem The Crisis Commentary Baltimore Sun

Student Loans Taxes Deductions Filing Returns And Retirement White Coat Investor

Maryland Student Loan Forgiveness Programs

Student Loan Interest Deduction Md Tax

States Step In Relieving The Burden Of Student Loan Debt Rockefeller Institute Of Government

Filing Maryland State Taxes Things To Know Credit Karma

Gov Larry Hogan Tax Credits For Md Residents With Loan Debt Wusa9 Com

Will Borrowers Have To Pay State Income Tax On Forgiven Student Loans Wolters Kluwer

Student Loan Moratorium Boosts Credit Scores Especially For Delinquent Borrowers Bloomberg